Our highlights

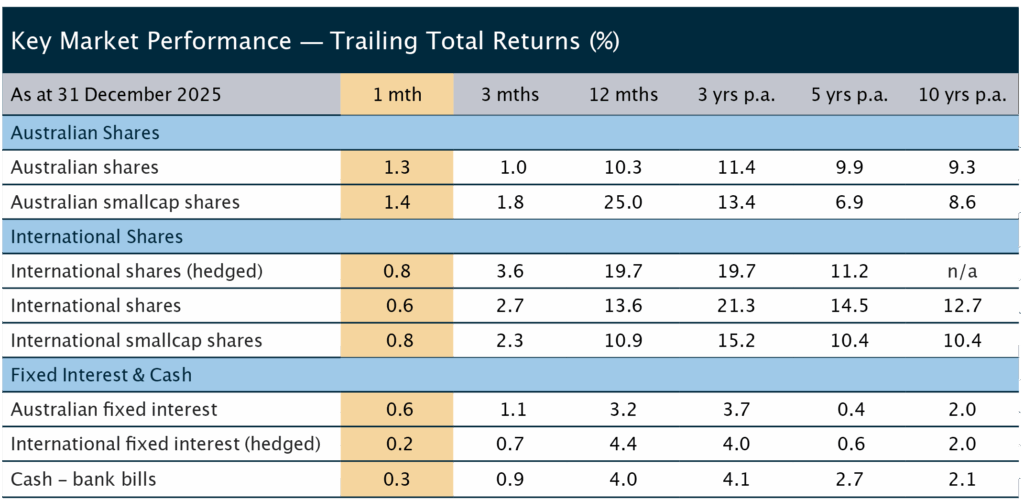

Global markets closed the year on a mixed but generally steady footing, shrugging off mid-month volatility and drawing support from the US Federal Reserve’s December rate cut. Gains were measured as investors stayed selective, while strength in defensive assets, commodities and gold helped counter valuation pressures in parts of the technology sector.

Australian shares closed the year higher after a choppy December shaped by shifting rate expectations and mixed economic data. A higher-than-expected inflation reading pushed back expectations for rate cuts, leading to uneven sector performance. Heavyweight sectors − materials, supported by higher commodity prices, and financials − lifted the broader market into positive territory, with all other sectors declining.

International share markets were broadly positive in December, with gains across most major regions. Europe led advances, the US edged higher amid easing expectations and valuation caution, while Asia was mixed, with Japan outperforming and China lagging. In a softer month overall, larger companies marginally outperformed global small caps as investors favoured balance-sheet strength and defensiveness.

Fixed interest markets remained mixed into year end. Global bonds edged lower as expectations

around the timing of US policy easing shifted, while Australian bonds also weakened as yields rose.

Higher bond yields weighed on credit markets, although global high yield proved more resilient,

supported by ongoing demand for higher income and relatively stable fundamentals.

Market observations and outlook

Market sentiment stabilised through December, with most global share markets ending the month modestly higher despite mid-month volatility, though the late rebound fell short of a traditional Santa Claus rally, underscoring continued caution in investor positioning. Earlier weakness in the US technology sector eased after the US Federal Reserve’s December rate cut, supporting expectations of steadier policy settings. Muted seasonal gains nonetheless reflected ongoing sensitivity to growth, inflation and valuation risks, with investors remaining selective and focused on earnings quality.

Looking ahead, the macro environment remains broadly supportive. Inflation has moderated across major economies, and corporate earnings momentum remains solid, even amid policy uncertainty, higher tariffs and softer patches in economic data. However, monetary and fiscal policy are diverging. The US Federal Reserve is expected to ease gradually, whereas inflation in Australia has proven more persistent, limiting the scope for rate cuts. This policy dispersion is influencing bond markets and creating opportunities in fixed interest, with Australian fixed interest offering relatively greater stability and more attractive risk adjusted outcomes in the US.

Several opportunities remain evident. Investment linked to AI remains a key structural driver, with unprecedented capital spending offering the potential for productivity gains over time. Beyond the largest US technology companies, industries that facilitate AI adoption may also benefit. Interest rate-sensitive segments, including global small companies, infrastructure and property, are priced at or near longterm averages, appearing relatively attractive compared with other equity asset classes trading at higher valuations.

At the same time, risks remain. Equity valuations are elevated, leaving little room for disappointment should earnings momentum slow. While inflation has eased, the risk of renewed upward pressure in the US remains material, reflecting tariffs, high government debt and ongoing liquidity support. Policy uncertainty surrounding US trade measures and the risk of excessive investment in AI-related capital expenditure may also contribute to periods of market volatility. In this environment, returns are likely to be more uneven and selective, reinforcing the importance of diversification, discipline and a continued focus on fundamentals as investors navigate 2026.