Our highlights

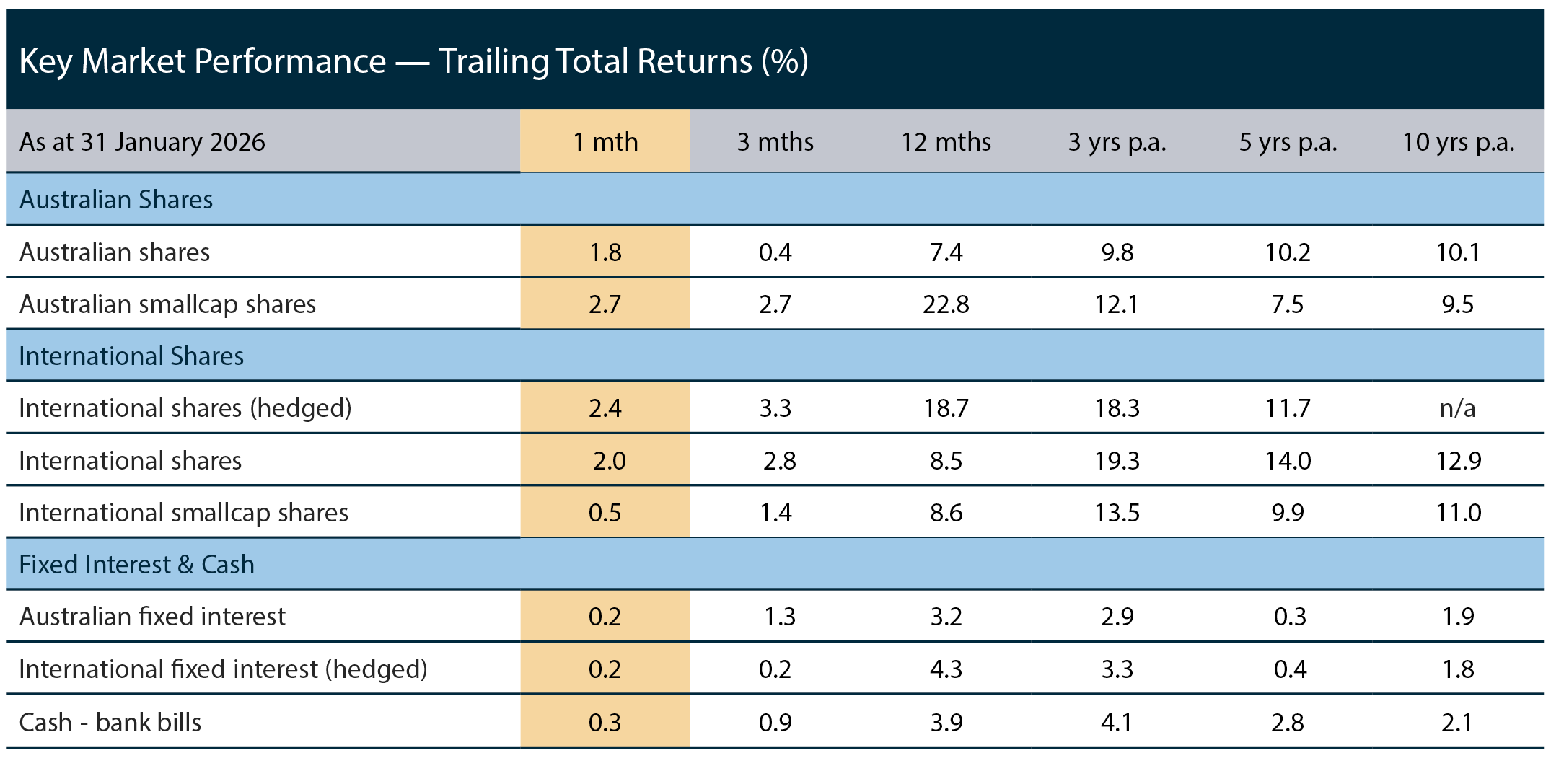

Global markets made a positive start to the year despite a heavy flow of headlines. Renewed tariff threats, geopolitical risks, a weaker US dollar and bond market volatility created a noisy backdrop, but investors remained focused on resilient economic conditions and earnings growth. Fiscal and inflation concerns weighed on government bond markets, while volatility picked up again in early February following a pullback in technology companies as AI-related valuations were reassessed.

Australian shares rose over January, supported by firmer commodity prices and strength in materials and energy. Persistent inflation reinforced a less supportive interest rate backdrop, with the Reserve Bank of Australia lifting rates in February and markets anticipating further increases into 2026. This pressured several interest-sensitive sectors, including financials, technology and real estate, and contributed to a relatively narrow leadership profile.

International shares delivered strong gains, although a stronger Australian dollar reduced returns for local investors. Performance broadened beyond the US, with Europe and parts of Asia leading developed markets. Japan benefited from improving domestic momentum alongside a more active policy and rates backdrop, while emerging markets were supported by a stronger month for China. Global small companies lagged larger peers.

Australian and global fixed interest markets posted modest returns, with higher bond yields weighing on government bond performance. Credit, or corporate bonds, delivered modest gains as credit spreads tightened. This reflected investors requiring less additional return to hold corporate bonds over government bonds, supported by confidence in corporate balance sheets and earnings resilience despite a less supportive interest rate backdrop.

Market observations

Australia’s economy is gaining momentum, moving beyond its earlier period of weak growth into a more sustainable expansion. Gross domestic product (GDP) growth is now close to trend at around 2.1%, supported by population growth, easing pressure on household incomes and resilient services activity. Growth is increasingly being driven by domestic demand rather than policy support, making the upswing more durable. Leading indicators, including improving business confidence and Purchasing Managers’ Index (PMI) readings above 50 (a level that signals expansion rather than contraction), point to steadier momentum ahead, even as inflation remains a challenge for policymakers.

A key positive development has been the return of the private sector as the main driver of growth. Household spending has remained resilient, rising 6.3% over the year, supported by stable employment and improved cash flows following earlier interest rate cuts. Business investment has also strengthened, with planned spending approaching $70 billion, led by areas such as renewable energy, electricity infrastructure, data centres and defence. This matters because non-mining investment typically has a stronger flow-through into domestic activity, wages and earnings over time.

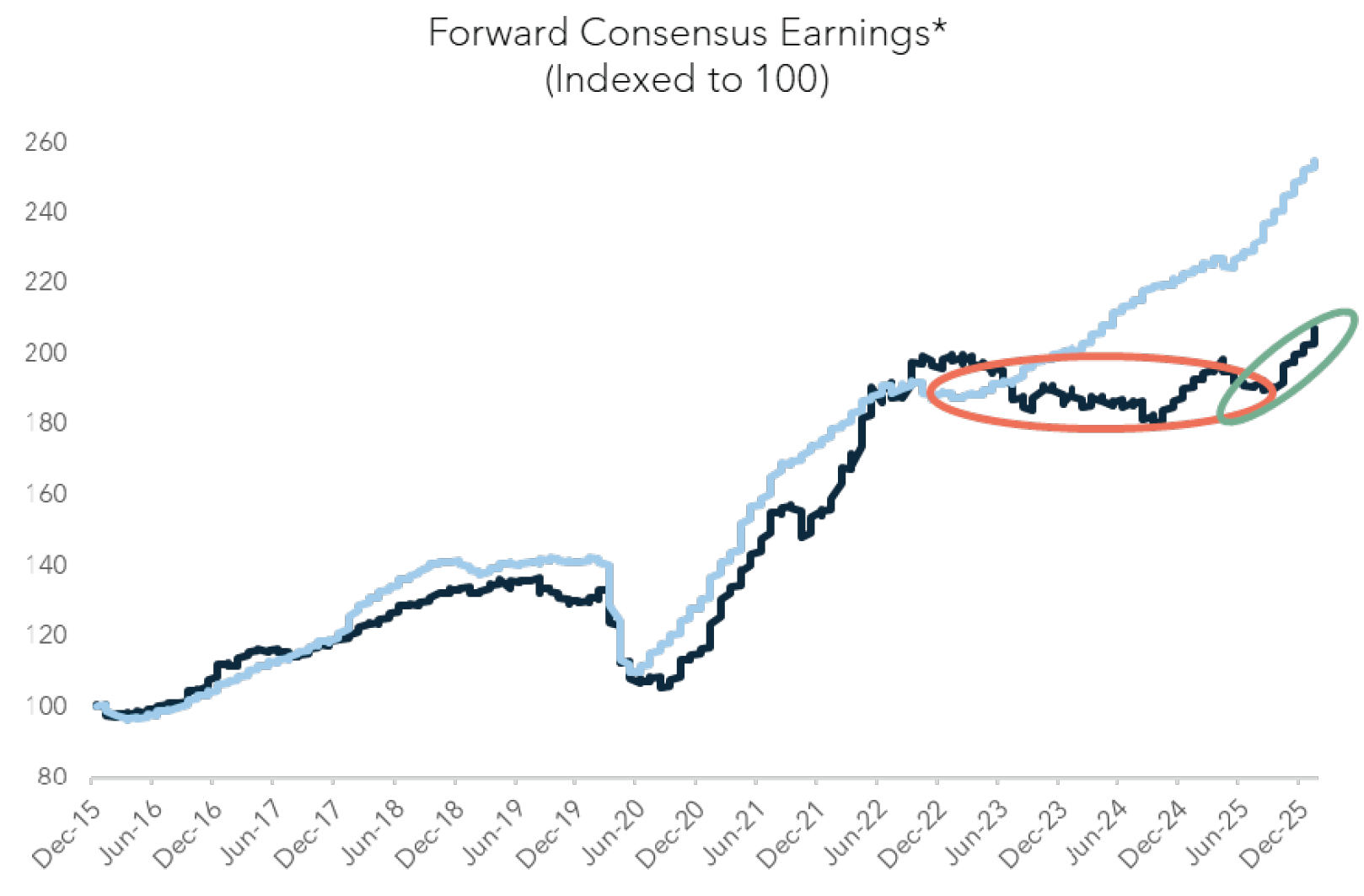

Corporate earnings are also showing early signs of improvement, with forward earnings per share (EPS) growth turning positive after three years of decline. However, the recovery remains narrow and is still largely driven by higher commodity prices boosting resource companies, while many other sectors continue to face earnings downgrades. For the earnings upswing to become more sustainable, stronger demand and investment will need to translate into broader revenue growth and margin improvement across the wider economy.

Source: Bloomberg, Evidentia