In July 2025, the Universities Accord (Cutting Student Debt by 20 Per Cent) Act 2025 (Cth) was passed by the Commonwealth Parliament to reduce student loan debt and increase the repayment threshold.

The Act amends the Higher Education Loan Program (HELP), the Student Financial Supplement Scheme and various other student loan debts. The Act introduced the following measures:

- Provide a one-off 20% reduction to HELP debts and other student loans incurred on or before 1 June 2025.

- Increase the minimum repayment threshold from $54,435 to $67,000 in 2025–26, indexed annually to wage growth.

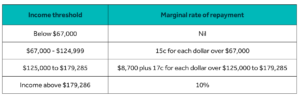

- Implement a marginal repayment system from 2025–26 where compulsory repayments are calculated only on income above the new threshold.

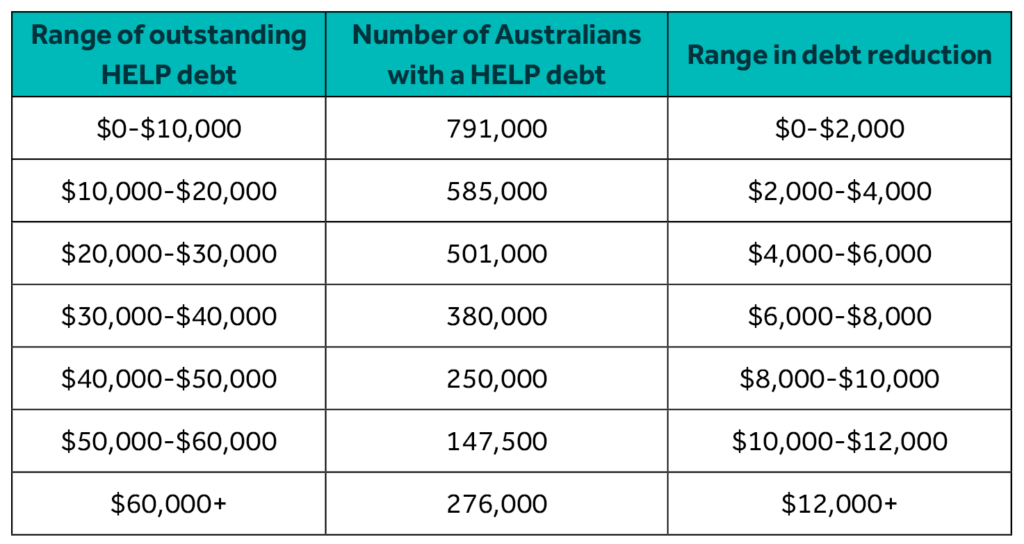

According to the explanatory memorandum accompanying the Bill, these measures will benefit approximately three million Australians with a student loan debt. It will particularly help younger Australians, with 70% of people repaying HELP debt being 35 years or younger.

HELP – background

The HELP is an income-contingent loan program assisting eligible higher education students with the cost of their student contribution amounts and tuition fees.

In November 2024, the Labour Party announcement highlighted,

- the measure will cut around A$16 billion in debt;

- for someone with the average HELP debt of $27,600 they will see around $5,520 reduced from their outstanding HELP loans in 2025.

Depending on the amount of student loan debt as at 1 June 2025, the amount of debt reduction varies and includes:

The above matters were also published in the May 2025 Federal Budget (Budget). According to the Budget papers:

- As at 30 June 2025, the fair value of HELP debt outstanding is estimated to be A$38.0 billion.

- There were 2,932,349 HELP debtors as at 30 June 2024.

- As at the end of June 2024, the average time taken to repay HELP debts was 9.9 years

What type of student loan debts will benefit and how?

Any of the following student loans will benefit from these measures:

- any of the HELP loans, including HECS-HELP, FEE-HELP, STARTUP-HELP, SA-HELP, OS-HELP

- VET Student Loans

- Australian Apprenticeship Support Loans

- Student Start-up Loans

- Student Financial Supplement Scheme

What happens next?

The 20% reduction in student loan debt will be calculated based on what a student’s HELP debt amount was as at 1 June 2025, before indexation was applied.

This means that indexation would apply only to the remaining loan debt balance e.g. after the HELP debt has been reduced by 20%.

An example in the explanatory memorandum provides:

A further example, in the explanatory memorandum, provides:

We would recommend student debts as at 1 June 2025 should be reviewed once the above rules have been implemented on student loan records held with the Federal Government.

Once the 20% reduction of student loan debt as of 1 June 2025 has been applied and the subsequent indexation processed, students will receive notification via their MyGov accounts and myHELPbalance.

New repayment thresholds – from 1 July 2025

From 1 July 2025, the Australian Government has changed the system of repayments of student loans based on marginal rates.

The minimum repayment threshold has also increased from $54,435 in 2024-25 to $67,000 in 2025-26. Currently, HELP repayment rates are set as a proportion of total income.

From 1 July 2025, a student will be required to make a repayment of a student loan where the person’s income is above $67,000.

These rates and thresholds will be indexed each year in line with Consumer Price Index (CPI).

What do these changes mean for study loan holders?

Per the ATO website, and depending on a taxpayer’s income:

- Most people will make a smaller compulsory repayment towards their loan debt from their 2026 tax return onwards;

- Some people will no longer need to make a compulsory repayment as their repayment income is $67,000 or less;

- People earning $179,286 or more will be no worse off.

Next steps

Please contact your Nexia advisor if you require any professional tax advice in relation to the above matters and the reduction of student loans or changes to the repayment thresholds.