Following the passage of amendments to the Corporations Act 2001 (the ‘Act’) that mandate climate-related reporting by certain companies, the Australian Accounting Standards Board (AASB) issued AASB S2 Climate-related Disclosures.

Effective for reporting periods beginning on or after 1 January 2025, AASB S2 requires entities to assess and disclose how climate-related factors impact their operations, financial performance and strategy.

This publication should be read in conjunction with our publication Mandatory Climate-Related Disclosures Legislation Passed which describes which entities are required to mandatorily apply AASB S2, the timeline for adoption, group reporting and alternative reporting requirements for Group 3 entities that have no material climate-related financial risks and opportunities.

Key requirements of AASB S2

The disclosure requirements introduced by AASB S2 are categorised into four pillars:

- Governance – the governance processes, controls and procedures an entity uses to monitor, manage and oversee the company’s climate-related risks and opportunities.

- Strategy – the company’s strategy for managing climate-related risks and opportunities.

- Risk management – the processes adopted to identify, assess, prioritise and monitor climate-related risks and opportunities, including whether and how those processes are integrated into the entity’s overall risk management process.

- Metrics and targets – information on the company’s greenhouse gas emissions, any climate-related targets it has set and its progress towards those targets, including any it is required by regulation to meet.

Governance

Governance forms the backbone of AASB S2, underscoring the importance of leadership accountability in managing climate-related risks and opportunities. Transparent governance disclosures build confidence among stakeholders by demonstrating that an organisation is proactively addressing climate-related challenges.

Role of the Board

AASB S2 places significant emphasis on the board of directors’ role in overseeing climate-related issues. Disclosures include:

- How the board monitors climate-related risks and opportunities. This includes the policies and procedures in place to integrate climate considerations into strategic decision-making.

- How the board ensures its members have the expertise needed to assess and manage climate-related matters effectively.

- How the board oversees the setting of targets related to climate-related risks and opportunities, monitors progress against those targets, and whether and how related performance metrics are included in executives’ remuneration policies.

Management’s role in execution

Management is responsible for operationalising the board’s directives and integrating climate considerations into business processes. Key areas of disclosure include:

- Who within the organisation is responsible for identifying, managing, and reporting on climate risks and opportunities.

- How policies set by the board are translated into actionable strategies, such as adopting renewable energy or updating operational protocols.

- Methods for assessing the effectiveness of climate-related actions, including performance reviews and regular reporting to the board.

Strategy

The strategy component of AASB S2 focuses on how the company adapts to and capitalises on the challenges and opportunities presented by climate change. It requires entities to disclose how these factors influence their long-term strategy and financial planning.

Identification of climate-related risks and opportunities

Under AASB S2, entities must disclose significant climate-related risks and opportunities, providing stakeholders with a clear understanding of their relevance. Climate-related risks and opportunities are those that an entity reasonably expects to affect its cashflows, access to finance and cost of capital (also referred to as the entity’s prospects), over the short, medium and long term. These include:

- Physical risks: Risks related to the physical impacts of climate change, such as rising sea levels, extreme weather events, or resource scarcity. For example, a company may disclose how flooding risks affect its infrastructure or supply chain.

- Transition risks: Risks associated with the transition to a low-carbon economy. These may include regulatory changes (e.g., carbon pricing, stricter emissions regulations), market changes (e.g., demand for greener products), or reputational risks from failing to meet the sustainability expectations of stakeholders.

- Opportunities: Opportunities related to climate action may include efficiency gains, cost savings, access to tax credits from renewable energy adoption, or access to new markets for sustainable products and services.

Impact assessment

Entities are required to assess the potential impacts of climate-related factors on their operations, strategy, and financial performance. These include:

- Operational impacts: Changes to supply chains, production processes, or physical assets due to climate risks. For example, businesses may need to relocate facilities or diversify suppliers to mitigate climate risks.

- Financial implications: The influence of climate factors on revenue, costs, and capital expenditures. Organisations may disclose expected investments in green technologies or costs associated with regulatory compliance.

- Strategic adjustments: Long-term strategies to enhance resilience, such as introducing sustainable product lines or adopting new business models aligned with climate goals.

Impact assessments provide insights into an entity’s ability to navigate an evolving climate landscape.

Scenario analysis

AASB S2 requires entities to conduct scenario analysis to evaluate the effects under two different climate scenarios. This involves:

- Creating scenarios: Developing hypothetical scenarios that explore different climate futures, including a range of temperature increases or regulatory environments.

As a minimum, an entity must develop at least two climate scenarios mandated by the Act – one being an increase in the global average temperature of 1.5°C above pre-industrial levels; and the other being at least 2.5°C above pre-industrial levels. Additional scenarios may be provided as relevant to the company’s circumstances.

- Testing resilience: Analysing how the company’s operations and strategy hold up under each scenario, identifying potential vulnerabilities and opportunities.

- Informing strategy: Using insights from scenario analyses to refine strategic priorities and align resources with long-term goals.

Risk management

Risk management processes are crucial for identifying, assessing, and mitigating climate-related risks.

Effective risk management starts with identifying climate-related risks across the entity and how the entity assesses the nature, likelihood and magnitude of the effects of those risks.

AASB S2 requires disclosure of the processes to identify, assess, prioritise and monitor climate-related risks and opportunities, including whether and how those processes are integrated into the company’s overall risk management process.

Metrics and targets

Metrics and targets provide a foundation for measuring and tracking progress of the company’s climate-related goals. AASB S2 requires disclosure of key metrics relating to the company’s climate-related performance.

Greenhouse gas (GHG) emissions

Companies are required to report gross Scope 1, Scope 2 and Scope 3 GHG emissions generated during the reporting period, expressed as metric tonnes of CO2 equivalent.

- Scope 1 emissions are those that an organisation emits from sources it owns or controls directly. Examples include:

- Energy generation within owned facilities and energy assets from non-renewable sources like generators.

- Emissions from company owned and leased vehicles.

- Scope 2 emissions are indirect emissions, derived from the company’s purchase of electricity, steam, heat, or cooling.

For example, electricity or natural gas purchased from a local power utility to power a building or facility.

- Scope 3 emissions – also known as an entity’s life cycle emissions. These arise across the company’s value chain, both upstream and downstream. Examples include:

- Upstream: waste generated in operations, business travel (from vehicles not owned or leased by the entity), employee commuting, upstream transportation and purchased inventory.

- Downstream: franchisee’s emissions, downstream transportation and distribution, and processing, use, and end-of-life treatment of sold products.

Financial Metrics

- Amount and percentage of assets or business activities vulnerable to climate-related transition risks and physical risks.

- Amount and percentage of assets or business activities aligned with climate-related opportunities.

- Capital expenditure, financing or investment deployed towards climate-related risks and opportunities.

- Executive remuneration linked to climate-related considerations.

- Internal carbon price used in investment decisions (if applicable).

Target Setting

In addition to reporting on metrics, entities are required to disclose their climate-related targets. This includes:

- Specific goals: Targets related to emissions reductions, energy efficiency, or renewable energy adoption. For example, achieving net-zero emissions by 2050.

- Progress updates: Regular updates on progress toward targets, including milestones achieved and challenges encountered.

- Alignment with industry standards: Ensuring targets are consistent with international frameworks, such as the Paris Agreement or Science-Based Targets initiative.

-

Proportionality mechanisms

Proportionality mechanisms are embedded in AASB S2 to allow entities to scale their disclosures based on their size, complexity and resources.

An entity is permitted to use all reasonable and supportable information that is available to the entity at the reporting date without undue cost or effort relating to the entity’s:

- climate-related scenario analysis;

- disclosures about the anticipated financial effects of a climate-related risk or opportunity;

- measurement approach, inputs and assumptions in measuring Scope 3 GHG emissions; and

- the amount and percentage of assets or business activities vulnerable to climate-related transition risks and physical risks and those aligned with climate-related opportunities.

-

In addition, an entity need not provide quantitative information about the anticipated financial effects of a climate-related risk or opportunity if the entity does not have the skills, capabilities or resources to provide that quantitative information. In that case, the entity explains why it has not provided quantitative information and provides qualitative information about those financial effects, including identifying line items, totals and subtotals within the related financial statements that are likely to be affected, or have been affected, by that climate-related risk or opportunity.

Transition

An entity is not required to disclose comparative information in the first annual reporting period it applies AASB S2.

Furthermore, in the first annual reporting period an entity is:

-

- not required to disclose its Scope 3 greenhouse gas emissions, including additional information about its financed emissions; and

- if, in the immediately preceding period, the entity used a method for measuring its greenhouse gas emissions other than the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (2004), the entity is permitted to continue using that other method.

Assurance timeline

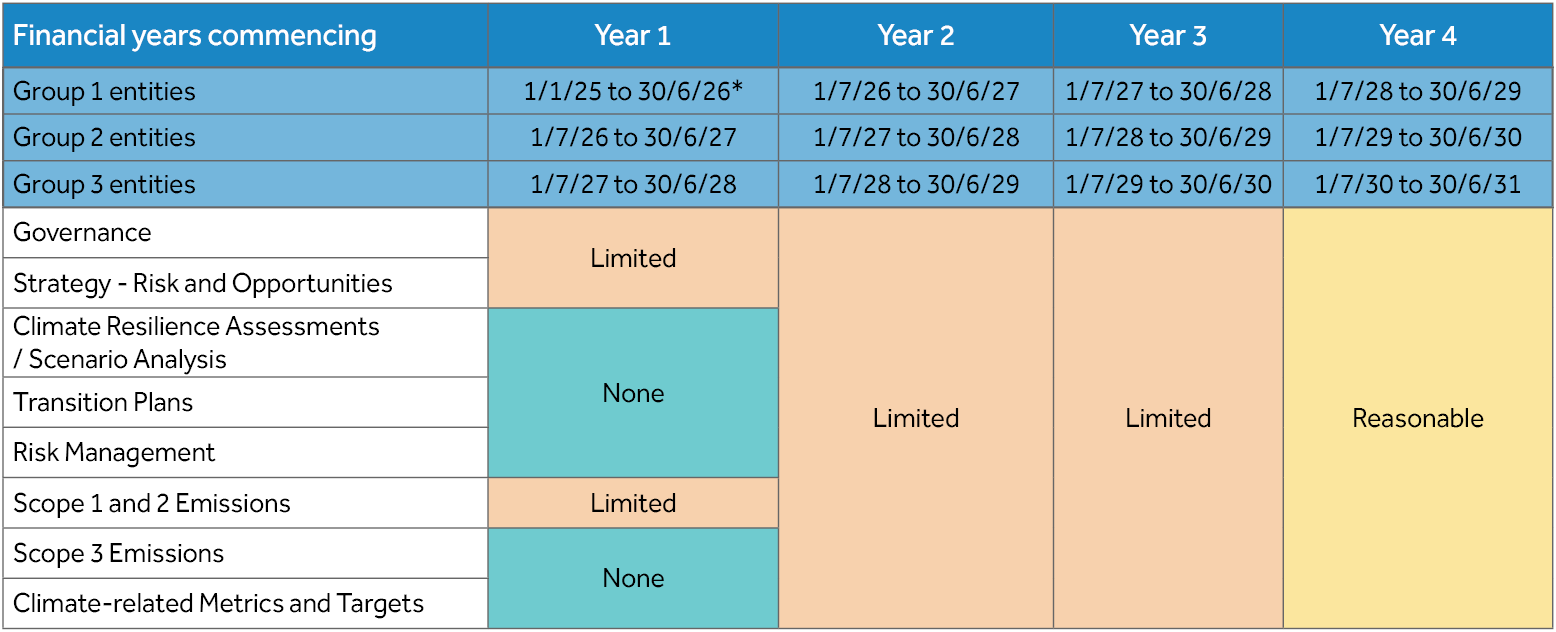

The Auditing and Assurance Standards Board issued ASSA 5010 Timeline for Audits and Reviews of Information in Sustainability Reports under the Corporations Act 2001, which outlines the minimum assurance levels required for various components of an entity’s climate-related financial disclosures.

The assurance phasing in relation to the key components of AASB S2 is:

* Group 1 entities with a 31 December year end apply Year 1 requirements twice (ie, years commencing 1/1/25 and 1/1/26).

Next steps

With the passage of enabling legislation, the sustainability reporting standard and assurance framework, affected companies need to start planning for climate-related reporting.

We encourage affected companies to familiarise themselves with the detailed disclosures required by AASB S2. AASB S2 is available on the AASB’s website at https://standards.aasb.gov.au/aasb-s2-sep-2024.

Contact your trusted Nexia advisor if you have any questions about the matters raised in this publication.

Understanding the key requirements of AASB S2 Climate-related Disclosures

Download PDF